Contents:

When appearing at bullish harami cross candlestick pattern bottoms it is considered to be a reversal signal. In this article, we will explore the features and benefits of the Auto Candlestick Patterns Detector. This advanced tool automatically identifies and analyzes candlestick patterns, providing traders with detailed explanations of each pattern when detected. This Candlestick Patterns Detector TradingView Script is an Auto Candlestick Patterns Detector Indicator for TradingView. The emergence of TradingView, a leading social network and charting platform for traders and investors, has dramatically changed the landscape of technical analysis.

A green Marubozu candle occurs when the open price equals the low price and the closing price equals the high price and is considered very bullish. A red Marubozu candle indicates that sellers controlled the price from the opening bell to the close of the day so it is considered very bearish. According to the book Encyclopedia of Candlestick Charts by Thomas Bulkowski, the Evening Star Candlestick is one of the most reliable of the candlestick indicators. It is a bearish reversal pattern occurring at the top of an uptrend that has a 72% chance of accurately predicting a downtrend. The second Harami pattern shown in Chart 2 above is a bearish reversal Harami which could also trigger a buy signal. Day 2 showed a bearish candlestick which made the bearish Harami look even more bearish.

Learn to Trade the Bullish Harami

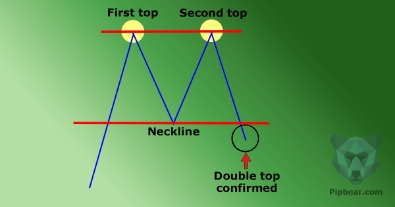

A bullish harami cross forms at the bottom of a bearish market while a bearish harami cross forms at the top of a bullish market. The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle. Now, another way of gauging the accuracy of a bullish harami is to compare the range of the pattern itself to surrounding candles. The bullish harami is a two candlestick chart pattern that appears at the end of a downward trend and signals that the current is about to reverse.

The harami cross pattern does not show profit targets through such a strategy. However, other techniques can be used simultaneously to determine the optimal exit strategy. In financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are 42 recognized patterns that can be split into simple and complex patterns. Author Thomas Bulkowski takes an in-depth look at 103 candlestick formations, from identification guidelines and statistical analysis of their behaviour to detailed trading tactics.

“Every Candlestick Patterns Statistics”, the last trading book you’ll ever need!

Hammer A black or white candlestick that consists of a small body near the high with little or no upper shadow and a long lower tail. Harami candlestick pattern is the opposite of the engulfing pattern, except that the candlesticks in the harami candlestick pattern can be the same color. The bullish harami candle pattern is a Japanese candlestick formation formed at the bottom of a bearish trend and indicates that the trend is about to reverse. Harami Cross Patterns are candlestick trading patterns that depict the indecision of buyers in the current trend in the market.

In this section of the article, we wanted to show you a couple of different approaches we use to improve the accuracy of different patterns. Unique to Barchart.com, data tables contain an option that allows you to see more data for the symbol without leaving the page. Click the “+” icon in the first column to view more data for the selected symbol. Scroll through widgets of the different content available for the symbol.

Bullish/Bearish Harami Cross Pattern in Candlestick Trading

The bullish harami pattern and the engulfing reversal pattern are quite similar, especially in the outcome. They are both two candlestick patterns that appear at the end of a downward trend and signal that the trend is about to reverse. Forex traders can better understand market dynamics and make more informed decisions by incorporating candlestick analysis into their trading strategies. Bullish and bearish haramis are among a handful of basic candlestick patterns, including bullish and bearish crosses, evening stars, rising threes, and engulfing patterns. A deeper analysis provides insight using more advanced candlestick patterns, including island reversal, hook reversal, and san-ku or three gaps patterns. The first candlestick is a long down candle which indicates that the sellers are in control.

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

Free members are limited to 5 downloads per day, while Barchart Premier Members may download up to 100 .csv files per day. Also unique to Barchart, Flipcharts allow you to scroll through all the symbols on the table in a chart view. While viewing Flipcharts, you can apply a custom chart template, further customizing the way you can analyze the symbols. Switch the View to “Weekly” to see symbols where the pattern will appear on a Weekly chart. Partnerships Help your customers succeed in the markets with a HowToTrade partnership. Trading coaches Meet the market trading coach team that will be providing you with the best trading knowledge.

The bulls even manage to push prices a little higher, albeit not above the open of the previous bar. If traders receive enough confirmation, they will most likely buy the security with the hopes the new upward trend continues and their investment grows. Trading Strategies Learn the most used Forex trading strategies to analyze the market to determine the best entry and exit points.

Elearnhttps://g-markets.net/s is a complete financial market portal where the market experts have taken the onus to spread financial education. ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. This means without any indicators, oscillators or moving averages, etc. The high or low of a Harami cross setup provides resistance or support for any further price moves. This signals that there is uncertainty in the continuation of the ongoing trend. The price is held up by the buyers and is unable to fall to the bearish close of Day 1.

Just as before, selling pressure is high and pushes the market even lower. HowToTrade.com helps traders of all levels learn how to trade the financial markets. Therefore, to identify the pattern, you need to find a two candle pattern at the bottom of a downward trend with the above features.

In the chart below, we have drawn Fibonacci retracement levels from the highest to lowest prices of the previous trend. As you can see, the 61.8% level helps us find a good entry level. Moreover, the stop-loss could be placed at the 78.6% level and the take profit target at 50%, and 38.2%. Live streams Tune into daily live streams with expert traders and transform your trading skills. Scan candlestick charts to find occurrences of candle patterns. A chart formation is a recognizable pattern that occurs on a financial chart.

Candlestick Screener: Find trade opportunities on The Economic … – Economic Times

Candlestick Screener: Find trade opportunities on The Economic ….

Posted: Thu, 18 Feb 2021 14:05:54 GMT [source]

The forex charts below exhibit both types of Harami patterns and how they feature within the forex market. The bulls drive the price higher, which creates that long white candle. However, this is followed by a doji, which signifies indecision. The price has stalled and neither the bear nor the bulls are in control.

This is followed by a doji, which shows indecision on the part of the buyers. Once again, the doji must be contained within the real body of the prior candle. As always, we recommend that you confirm the Harami Cross candlestick pattern before making any rash decisions. For a bullish Harami Cross, check that the price trades above the pattern, and for a bearish Harami Cross, check that the price trades below pattern. In addition, remember that a Harami Cross can predict sideways movement or a complete reversal. So before you make any major decisions based on the appearance of a Harami Cross, note that this isn’t the most predictable of candlestick patterns.

A bearish harami cross appears during and at the top of an uptrend. Its identification criteria are the same as the bullish harami cross. The first candle here indicates that the buyers are in complete control of the market. Then the appearance of the second candle, a Doji, suggests that some degree of indecisiveness and uncertainty has also entered the market. A bullish harami cross appears during and at the bottom of a downtrend. It can be identified by spotting a pattern where the first candle is a big one and the second candle is Doji totally embodied in the first candle.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

A doji is a trading session where a security’s open and close prices are virtually equal. Explore the Harami candle in relation to reversal patterns to identify possible trading opportunities. In this first example, the bulls meander in an uptrend, occasionally letting the bears dip the price downward before they seize the reins again. The bulls push the price a bit higher, but their upward thrust is followed by a period of indecision. The uptrend will likely conclude with the doji, either moving sideways or downward after that. The method also works better with market shares that are expected to make significant movements.

The Takuri Line cannot be regarded as a confirmation of the Bullish Harami Cross. The Have Wave candle closed below the opening of a Black Candle, being the first line of the Bullish Harami Cross pattern. It is generally indicated by a small increase in price that can be contained within the given equity’s downward price movement from the past couple of days. The nature of a stop-loss system allows a buyer flexibility within the market. Any market environment is conducive to a stop-loss order, as the order only goes into effect when a designated price is reached.

コメントを残す