Contents:

They consist of a price range that becomes too narrow and results in a final breakout that marks a trend reversal. Forex chart patterns are great to identify potential entry and exit points, establish profit targets and stop losses which are the basic elements of a trading strategy. The rectangle pattern is a price action formation that can be recognised by prices being confined by two horizontal support and resistance levels.

- Some common price action chart patterns include head and shoulders, double bottom, and triple bottom.

- The target profit can put at the distance that is shorter or equal to the height of the middle peak of the pattern .

- Bearish candlesticks – usually represented by red colour depending on your chart settings.

- Chart patterns are specific and repeated areas on the price charts and sometimes they are called price patterns or formations.

- Forex chart patterns can assist you in entering a trade on the low and then exiting with a high.

The formation is rather a way to trade the price channel than an independent pattern of technical analysis. It is classified as a pattern because it steadily works out and is quite efficient. The candles must follow each other, sloped in the direction of the main trend. After the series of small candles is completed, there is a sharp price jump via one or two candles in the direction, opposite to the first candlestick in the pattern. You can seldom come across the pattern in the classical technical analysis, as it was discovered as early as in the 1990s, and is hardly remembered nowadays.

What are patterns?

The low of the head is subtracted from the high of the shoulders and the resulting figure is thenaddedto the breakout price. Whilst this system is not ideal, it provides an approach for trading the markets based on logical price moves. With such a variety of ways to trade Forex currencies, understanding the most common trading methods can save a lot of time, money and effort. By using popular and simple approaches, a trader can design a completetrading planusing Forex chart patterns that frequently occur and can be easily spotted with little practice. Unlike the head and shoulders pattern there isn’t a maximum and a decreasing point. Instead, on the double top pattern , is made of two equal maximum points quite similar to each other.

Another reversal pattern that resembles the double top/bottom is the triple top and triple bottom which has an additional peak respectively an additional valley . Conversely, the bearish candlesticks are pointing downwards, and show that the prices have dropped over that period. In this case, the top of the real body shows the opening price, while the bottom the closing price. Chart patterns are arguably one of the most popular tools of technical analysis. Although they are fairly simple patterns, the close similarity between the bullish and bearish rectangles can confuse new traders. Click here for a more in-depth explanation, additional examples, and interesting strategies.

Then, we’ll show you popular forex patterns and explain them one by one. Trend channels refer to price channels indicating the sideways price movement between a resistance zone and a support zone. The Bump and the Run pattern is a chart pattern that consists of two phases of the market the Bump and the Run. Engulfing patterns, which are incredibly easy to identify, occur when a candle’s real body completely engulfs the previous day’s. Any information or advice contained on this website is general in nature only and does not constitute personal or investment advice.

thoughts on “19 Chart Patterns PDF Guide”

While patterns are not as easy to pick out in the actual Ichimoku drawing, when we combine the Ichimoku cloud with price action we see a pattern of common occurrences. The Ichimoku cloud is former support and resistance levels combined to create a dynamic support and resistance area. Simply put, if price action is above the cloud it is bullish and the cloud acts as support. If price action is below the cloud, it is bearish and the cloud acts as resistance. There exist over 150 candlestick patterns and 80 chart patterns approximately. Still, there are patterns discovered at the very beginning of the technical analysis era.

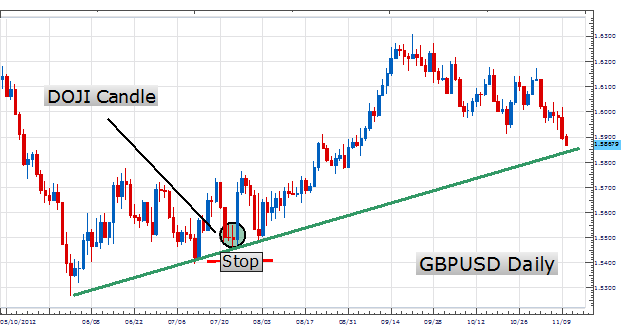

A reasonable stop loss can be placed at the level of the local low, marked before the resistance breakout . Currently, there are many different kinds of triangles; however, they are all based on the same principle. In the common technical analysis Triangle is in the group of continuation chart patterns. It signals that the trend, ongoing before the triangle appeared, can resume after the pattern is complete. Double Bottom chart pattern is formed at lows within a descending tendency.

Types of patterns

Engulfing chart patterns are an outstanding trading chance since they can be very well recognized and the price activity exhibits a powerful and quick shift in direction. In a downward trend, and up-dip actual body would ultimately cover the previous down-dip actual body . In an upward trend, a down-dip actual body would ultimately cover the previous up-dip actual body .

What is Forex Technical Analysis? – Benzinga

What is Forex Technical Analysis?.

Posted: Mon, 27 Feb 2023 21:50:35 GMT [source]

I suggest analyzing the scenarios of both upside and downside https://g-markets.net/ on the given example. We open a sell trade according to wave 6 when there are indications of the trend reversal following wave 5 . We enter a buy trade only when the trend reversal is clear following wave 4 . The pattern is negated if the price breaks the downward sloping trendline. The pattern is negated if the price breaks below the upward sloping trendline.

The target profit is set at the distance equal to or shorter than the width of the biggest wave inside the pattern . A reasonable stop loss here will be at the local high, preceding the support line breakout . It is reasonable to place a buy order when the price, having broken out the resistance line, reaches or exceeds the last local high, preceding the resistance breakout . Sometimes, you may lose about 3% of the price movement between the point of the resistance breakout and your entry. Target profit can be put at the distance, equal to or less than the breadth of the pattern’s first wave.

This is because chart patterns are publicly available information. You can find chart patterns on any chart, but chart patterns at important psychological levels are more meaningful. A bearish trend continuation occurs on the chart when the support zone breaks. The breakout of the neckline always confirms the trend reversal.

GBP/USD Technical Analysis – Awaiting NFP – ForexLive

GBP/USD Technical Analysis – Awaiting NFP.

Posted: Tue, 07 Mar 2023 09:40:00 GMT [source]

It progresses significantly below the previous low to form the head of the pattern. The pattern is completed when the price breaks below the neckline, which is the line connecting the low of the shoulders. The psychological forces that are supposed to form these patterns also require time to play out. Patterns on higher charts such as the daily might be more meaningful than intraday patterns. The traditional academic view has always centered on the notion that investors are rational and market prices properly reflect whatever information is available to them. A pattern consisting of a large price drop and a subsequent consolidation bounded by two parallel trend lines that point up.

The butterfly pattern can also look like a capital “M” on a bullish pattern or a “W” when the trend is bearish. When you’re able to identify these patterns, you can make a lot of money because you’ll be able to predict with relative confidence when a price is about to shoot up or shoot down. Unfortunately, with so many different patterns out there, it can be difficult to figure out which ones are best for determining where prices will go in the near future. Of retail investor accounts lose money when trading CFDs with this provider. The vertical distance between the Head and the Neck Line applied starting from the moment of the breakout.

What you do next will have a profound impact on your results as well as your perception of the reliability of chart patterns. Therefore, a pattern formed at this higher timeframe is more likely to reveal useful insights regarding market dynamics than the same pattern formed on intraday charts. Even the simplest forex chart pattern can be incorporated into many different trading strategies in many different ways, resulting in different profit/loss profiles. Those who belong to this group want to beat the market through fundamental analysis, technical analysis, or the combination of the two. It would be best not to confuse the descending wedge pattern with the descending channel pattern because the trendlines in the descending channel are parallel. In this type of channel pattern, the price makes lower lows and lower highs.

When the price reaches a new high, it shows conviction behind the uptrend. Each trend alternates between impulse and consolidation moves, so the correction following the high is to be expected. Instead of worrying about every little detail, focus on what certain formations reveal about the balance between buyers and sellers. Chart patterns are often simple formations such as two failed attempts to achieve a new high price.

With each chart pattern, you can use the formation height and add it to the breakout price to get the profit target. If forex chart patterns were very reliable, every market participant would closely monitor them. Once a signal was present, the market would be flooded with orders and the price would immediately rise or fall to the foreshadowed rate.

A reasonable buy popular forex chart patterns can be placed when the price, having reached the support level of the line, reaches or breaks through the local low, previous to the current low . The target profit can be set at the level of the local high, followed by the current one, or higher . A reasonable stop loss can be placed a little lower than the low, after which you entered the trade . In technical terms, the formation looks like a broadening sideways channel that can sometimes be sloped.

コメントを残す