Contents:

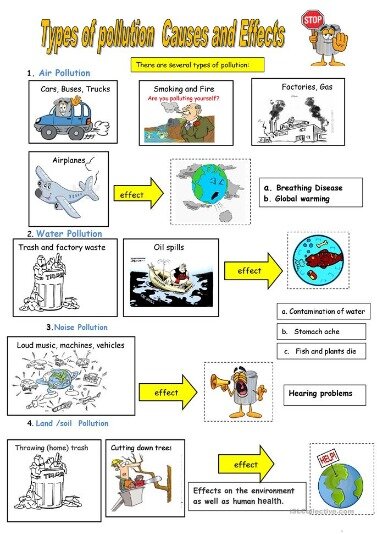

Waiver of NASDAQ Level II and Streaming News subscription fees applies to non-professional clients only. Access to real-time market data is conditioned on acceptance of exchange agreements. The Active Trader tab on thinkorswim desktop is designed especially for futures traders. Click here to learn about How To Invest In The Commodities Market. We can create tailored solutions to meet the specific needs of such institutions, as they see fit. Moreover, our aggressive futures commissions and low day futures trading margins further help these high-volume traders achieve their goals.

Traders agree to buy or sell an asset at a predetermined price and date. Futures are great for trading certain investments like currencies, indexes, and commodities. Generally, futures contracts have high levels of leverage which is excellent if you’re cautious about risks. Whether you’re a beginner or an advanced trader, having access to a full-featured trading platform is a must.

Learn the fundamentals and gain technical knowledge in this guide.

E-https://trading-market.org/ is a web-based platform that is easy to use and offers an array of tools specifically for futures trading. Their easy-to-use platform makes them a good candidate for beginners. Interactive Brokers offers access to products in over 135 global markets at industry-low trading fees.

Plus, they don’t charge an inactivity fee if you haven’t made trades within a certain period of time. AMP Futures is a futures broker specialized in providing access to more than 60 futures trading platforms to clients. They have two group entities – AMP Global USA and AMP Global Europe. As a US-based broker, AMP Global USA is regulated by the Commodity Futures Trading Commission and National Futures Association .

He writes personal finance and investment advice for The Ascent and its parent company The Motley Fool, with more than 4,500 published articles and a 2017 SABEW Best in Business award. Matt writes a weekly investment column (“Ask a Fool”) that is syndicated in USA Today, and his work has been regularly featured on CNBC, Fox Business, MSN Money, and many other major outlets. He’s a graduate of the University of South Carolina and Nova Southeastern University, and holds a graduate certificate in financial planning from Florida State University. A feature-packed trading platform with all of the other functionality of TD Ameritrade.

best commodity brokerscurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero. This futures trading book is a sensation on how to control the exchange of commodities and future agreements in the world of derivatives. It provides a perception of how trading psychology works in a high-frequency computer trading world and how to avoid the current downfalls. The book further offers a broad analysis of electronic trading with present-level agreements and new-fangled trading techniques, as well as the author’s select Pivot Indicator method. An advantage of options on futures is the ability to reduce risk in your portfolio in different ways.

Futures margins refer to the amount of money that traders deposit and keep on hand when future positions are opened. Optimus Futures has excellent customer service that ranges from phone to email support. For beginners or traders wishing to brush up on their knowledge, they have a YouTube channel with a thriving community. They charge $2.25 per contract along with exchange and regulatory fees. They offer a subscription-based proprietary platform that works seamlessly across all devices. NinjaTrader platforms are free to use, and there is also simulated trading available without having to fund the account.

Go to schwab.com/satisfaction to learn what’s included and how it works. Energy contracts provide exposure to the price of common energy products used by companies (for manufacturing, production, and/or transportation) and by governments and individuals for consumption purposes. Currency contracts provide exposure to the exchange rate of a real currency or crypto currency. In 1990, Jim received an intriguing offer from Andy Daniels to join him at Linnco Futures, and they have worked together ever since. Currently, Jim is Senior Vice President at Daniels Trading, using his extensive background in trade execution, brokerage, and back-office navigation.

The Ascent’s picks for the best futures brokers

At Cannon Trading, we focus on exceeding expectations for all of our clients. Our team focuses on speed, reliability, and superior customer service for all of our clients. Most of our programs feature a free demo, making it easy for traders to find an application that best meets their needs. Traders can consult with a series 3, licensed commodity broker for feedback regarding preferred order routing, front end, risk management and more. The long report, in addition to the information in the short report, groups the data by crop year, where appropriate, and shows the concentration of positions held by the largest four and eight traders.

The European entity AMP Global Europe is authorized by the Cyprus Securities and Exchange Commission as a Cypriot Investment Firm . Your individual style will determine the best broker for futures trading, which is why we offer five options, each with different strengths. We compared each platform’s ease of use, trading tools and pricing.

Testimony by Chairman Rostin Behnam Before the Subcommittee … – Commodity Futures Trading Commission

Testimony by Chairman Rostin Behnam Before the Subcommittee ….

Posted: Tue, 28 Mar 2023 19:08:24 GMT [source]

The fast onboarding process means you can start with Plus500 shortly after landing on the homepage. Also, Plus500 doesn’t charge you for futures market data, and the low commission ensures you can enjoy a competitive pricing model. The Futures Academy ensures you can access detailed articles and videos on how to trade futures.

Customer Service

If prices seem set to drop, brokers try to arrange futures contracts based upon the current market price. This means the buyer has to pay the going rate as of today rather than the market price at the time of purchase. When this occurs, the broker makes a profit and earns a commission. If prices seem likely to fall, brokers try to negotiate deals to buy commodities at a future date for a price below the current market price. Our robust futures trading platforms help to give our clients an extra edge over other traders.

This allows you to invest a much larger amount of money but potential losses are also considerably bigger. Cryptocurrency transaction and custody services are powered by Zero Hash LLC and Zero Hash Liquidity Services LLC. Cryptocurrency assets are held and custodied by Zero Hash LLC, not tastytrade. Cryptocurrency assets are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation coverage.

A commission is paid to the firm in exchange for technical support, customer service, education, etc. Many retail brokerages charge about $1 to $1.5 per side and contract. Introducing brokerages like Optimus Futures charge as low as $0,10 per side per contract for highly active traders. Unlike day-trading stocks, actively trading futures isn’t covered by Pattern Day Trader rules, which requires stock day traders to maintain a minimum account value of $25,000. Brokers have their own minimum requirements to be approved for trading futures, so you may need to find a broker that is willing to allow you to trade. How much you have to pay for a trade in spreads, commissions and other trading costs is a key broker selection criteria.

20 Best Crypto Copy Trading Platforms: A Curated List 2023 – Coin Culture

20 Best Crypto Copy Trading Platforms: A Curated List 2023.

Posted: Fri, 10 Mar 2023 08:00:00 GMT [source]

Online brokers vary from retail pricing to discount trading rates. If you are still uncertain what financial assets you want to trade on exchanges of your choice, then a retail brokerage is a good decision. Most of them offer commission-free stock trading for people living in the United States and offer futures trading along as a side service.

Interactive Brokers is far and away the best online broker for futures trading veterans. In addition to being our top choice for professional futures traders, Interactive Brokers is also our top-rated broker for professional, advanced, and international traders. This is because IBKR offers more markets to trade through a single platform than any other broker. Moreover, IBKR’s trading technology is among the best of all online brokers. Optimus Futures is a futures trading platform that is based in the United States. They have very low fees compared to others, which futures traders will enjoy.

The article is checked by our editorial team, Which includes entrepreneurs who are painfully aware of how overwhelming and challenging it is to start a business for the first time. Buying a stock will give you ownership over something, relative to the amount you paid, for example, you can buy a stock that will give to 1% ownership of a company. Moreover, if a bad trade puts you below this number, you can’t day trade to recover the loss until your balance is restored to $25,000.

- BrokerChooser does not provide investment or any other advice, for further information please read our General Terms and Conditions.

- TD Ameritrade has extensive educational content and offers free online seminars.

- The new features include video tutorials, live trading videos, an updated user interface and an improved search function.

- A futures contract is a legally binding agreement to buy or sell the specified volume of the underlying asset by the delivery date.

Capital.com is a beginner-friendly trading platform that offers some of the best educational resources in the industry. Using the Education Hub, you can discover how to trade in the financial markets and take courses that enable you to improve your proficiency level. Other futures trading options on Trading 212 include commodities, indices, and stocks.

- For reportable positions, additional data is provided for commercial and non-commercial holdings, spreading , changes from the previous report, percent of open interest by category, and numbers of traders.

- A sell-to-close order allows you to exit your existing long position.

- Our futures platforms give traders access to an interface specifically tailored to their trading needs.

Margin requirements are the minimum amount you can set aside to trade futures contracts. Margin requirements depend on the asset and index you wish to trade. Another aspect is that futures contracts contain underlying assets such as commodities, metals, energies, and equities. It is essential to ensure that the platform you choose offers robust educational content. This helps you familiarize yourself with trading and the stock market. It can help you develop a trading strategy and decide which assets to trade.

Leave a Reply